The card prides itself on its top-notch service. Of course, there’s no spending limit, because if you’re the kind of guy who has a diamond in his credit card, you don’t need one. And there are no annual fees, but there is an AED7,000 (P84,242) joining fee (as of 2011). Not only that, you even get 4% cash back on all purchases.

For one customer, wanting to try the latest Porsche, the bank flew him out to Stuttgart, Germany so he could test-drive it. The concierge services can hook you up with tickets to the Oscars. “What are their needs? It’s not money – it’s service,” al Ansari said. The bank has partnered with Quintessentially, a luxury services company, to provide dedicated concierge services for the super-rich who own this card. You have to be invited, and the bank scouts clients from all over the world. Not just any person can apply for these cards. It’s available to members of the royal family and people with ultra-high net worth. Ibrahim al Ansari, chief executive of Dubai First, told The National that this is “the most exclusive credit card in the world”. 235-carat diamond smack dab in the middle of it. Precious metals not doing it for you? How about precious gems? Not only is the Dubai First Royale Card trimmed with gold, but there’s a white. Also, did we mention it’s made of gold (and palladium)? 3.

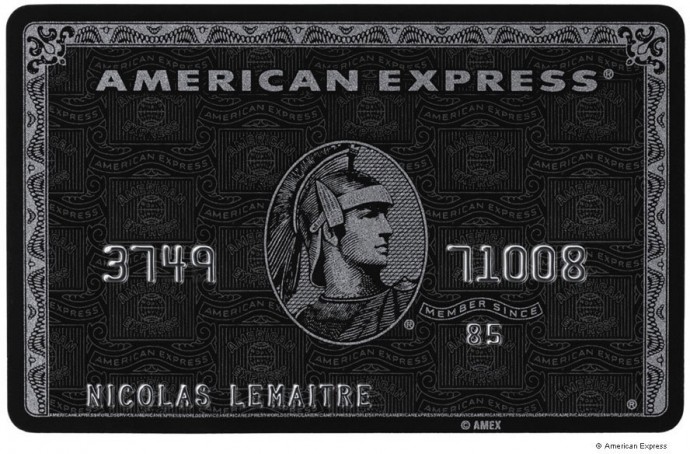

#American express centurion card hong kong free

There are many other benefits to holding this card, and you can cash in your points for skydiving lessons, free golf lessons with a pro, and other exclusive rewards. You also get access to more than 600 airport lounges worldwide, and if you don’t want to fly with the plebs, you can use MarquisJet, the world’s largest fleet of private jets. There are no foreign exchange fees, late fees, cash advance fees, or overdraft fees. And once you hit $100,000 (P4.42 million) in spending, you get a bonus 35,000 points. What benefits do you get? Well, you get 1 point for every dollar you spend on the card, and 2 for every dollar you spend on travel. The annual fee, according to Dr Credit Card, is $595 (P26,308). To qualify for the Palladium Card, you need to have a private banker with JP Morgan, and the minimum for that is $1 million (P44.21 million), although Chase Private Clients can also qualify, lowering the minimum to $250,000 (P11.05 million). Getting this might be even harder than getting a Centurion Card. Your name and signature are laser-etched onto the card. A Bloomberg report estimates that the materials of the card alone cost $1,000 (P44,216). Titanium cards too pedestrian? Try this card on for size - launched in 2009, it’s made of palladium and 23K gold. Benefits differ from country to country, but it’s safe to say that almost everything is within your reach with the Centurion Card. Want to rent a Formula One car? The concierge service can arrange that for you. For this purchase, Liu Yiqian won 422 million American Express points, which he can exchange for “28 million frequent flyer miles or about $180,000 (P7.96 million) worth of vouchers at Hong Kong retailer ParknShop,” according to Bloomberg Business.Ĭardholders also get access to a whole host of ridiculous things, a lot of which American Express keeps secret, but some details are available out there. There’s no limit on the card, so you can charge, as one customer did in 2014, HK$281 million (P1.60 billion) to buy an ancient Chinese ceramic cup from Sotheby’s Hong Kong. Yikes.īut what do you get for all these fees? Just about anything you want. The Wall Street Journal reported that it’s only available to customers who charge more than $250,000 (P11.05 million) a year. How do you get a Centurion Card? Well, you don’t apply for one. It’s black because of the anodized titanium the card is made out of. Eventually, American Express decided to cash in on the rumor, making the Centurion Card in 1999 available for only its richest customers. In the early 1980s, rumors of a super-secret high-end American Express “black card” started going around.

“The Black Card” is the most popular exclusive card out there, the one everyone’s heard of. So what are the credit cards for the super rich? Here are five of the most high-status, exclusive credit cards that you might find in their wallets: 1. These ultra-high-net-worth individuals look for “special access, unparalleled benefits, and enhanced customer experience” when choosing a credit card, according to a survey by the Luxury Institute. While you might need to get free travel insurance on your flight, they need to hire a private jet at a moment’s notice with their credit card. The super rich have different needs than the rest of us.

0 kommentar(er)

0 kommentar(er)